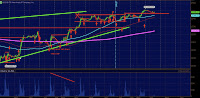

Currently the relationship between the ES and T complex is fairly in tact though both bonds and ES are red with 1556.50 trading but by only fractional perfect. The 1553.50 level is the pinch lower area with 1550 before 1545 as mechanical support.

Since today the Fixed income markets are closed for half day and tomorrow markets observing Good Friday, you can expect some end of month games; so be aware.

FX & T-Complex

|

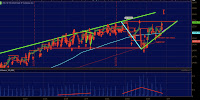

| 6 E 5 min |

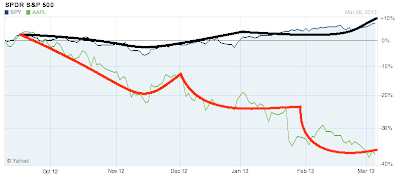

If the ZB can continue lower under 144'09 the ES bid should continue to firm up into 1560. The DX is lower to 83.30 up from a 83.20 low which hels to the penny. A break under 83.20 means 83.10 launch pad from Wednesday morning comes into play.

The Euro is high as well by 0.21% to 1.2809 afters eeing the 1.277 level hol early Thursday morning it gave me confidence in putting 1.276 as line in sand support before back to Wednesday low of 1.2758.

Crude Oil

|

| CL 5 min |

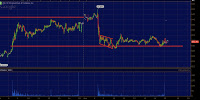

On the flip said the 96.60 level if converted back to suport will provide the launchpad into 97, especially if the DX falls off and 6E continues to retrace Wednesday's drop.

In order to take out highs 96.94 need to be lifted quickly after 96.85 an bids defended as price moves higher without a snap back.

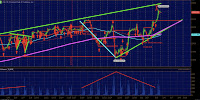

| ES_F | NQ_F | CL_F | TF_F |

|---|---|---|---|

| R1: 1559.50 | R1: 2805 | R1: 96.50 | R1: 449.50 |

| R2: 1565.75 | R2: 2811 | R2: 96.94 | R2: 451 |

| S1: 1553 | S1: 2800 | S1: 96.35 | S1: 945 |

| S2: 1549.75 | S2: 2890 | S2: 96 | S2: 942 |

Want the TFP Morning Letter delivered to your inbox by 9 am ET? Subscribe Here for $25mo.