|

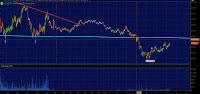

| 15 min ES |

A similar scenario to yesterday morning is playing out in the complex currently as the S&Ps are down 5 points to 1512.25 after trading as low as 1510 which makes 1510 the line in sand to watch. Resistance is 1517.50 under 1510 its 1505. Perhaps today will be the day we come off a bit.

NQ futures failed the 2765 level to fall into 2756. Looking at the chart on the right you can see how large the volume was when the CYAN line i pointed out last night failed.. Pretty funny the line fails for the first time AFER i write about it. Currently NQ is lower by 9 points @ 2761.25. Under 56 sell stops over 66 buy stops.

|

| 5 min NQ. note CYAN |

The DX is higher by .60% to 80.615 which is a nearly 1 percent retrace from the break down in dollar Tuesday, vey non natural looking move up off 80 into 80.71 if you ask me, also volume much lower than Tuesday and monday already. over 80.71 its 80.75-81 as a risk.

|

| DX 1 hour |

6E has been completely smoked to make a new monthly low of 1.3317 down 1 percent currently @ 1.3329 under 1.3317 its 1.33 test.. Honestly the Euro has moved down an incredible amount in the past week considering how much its moved up

If bond and DX strength keeps the 1510 level in the ES is not going to hold as sellers are becoming more and more persistent. under 1510 its 1505 or 1500. If we fall 10 more handles today thats a 22 point move in less than 24 hours.

Clearly this fixed incomes strength is what is weighing on the tape as nothing as material beyond some softness out of GDP from France and Germany. ....but come on honestly who really thought Europe was growing fast after all the crap they have been through the last 3 years.

Commodities

Crude oil is higher by .20% to 97.21 after trading in a wide swath from 97.41 to 96.75 overnight... All more signs the market is frothy and influenceable. UNDER the LOW for CL it means back to yesterday;s low of 96.63, over highs its back to 97.50. Dont play the in between unless you like being mincemeat.

Gold and silver have rallied with bonds and the dollar which is different from what we have been seeing correlation wise the past few weeks. Currently GC is lower by 2 points after falling on the positive jobless claims print. now the low its 1636.50, below tuesday's low.

|

| 14 min crude showing 1640 failure |

Silver is unchanged at 30.86 down from over 31.05. Silver is nonsense. Copper is higher by 0.12% to 3.747 after 3.73 held as support early this morning.. Over 3.751 = buy stops into 3.765.

Stocks

Apple is lower to 466.26 under 465 its lights out. Apple has been a pile of crap for 6 months now. why would it improve today?

BBRY shares are on lows down into 13.30 .. thats a 70 cent drop from wednesday's close. Getting stupid in this stock down almost 20 percent in a few days.

CSCO reported a decent quarter yesterday after the close. shares are unchanged @ 21.14 from Wednesday's close though..

Ketchup maker HNZ was bought by Berkshire for 23 billion .. shares are @ 72.50 pre market up from 6048 close.