Sign up for the TFP insider & private twitter here. The letter goes out to subscribers at 7:30 am CT.

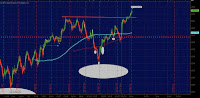

Good morning and welcome to the TFP letter. Today's tape looks moderately soft at this point with the S&P 500 futures well off their highs of 1484.25 at 1476.50 currently.

Much of the tape needs to consolidate and digest the past week's up move so do not be alarmed if we break 1470, but i would not be surprised if we take out 1485 before the day is over.

We are currently waiting for one of two things to happen before a trade is triggered in the spooz which is a break over 1484.25 converting into 1490 or a failure of 1475.50 converting into a test of 1470's from last week. In between one could play 1480 as support if the price moves back before the cash open.

Much of the overnight weakness in aud/jpy eur/jpy can be attributed to

Japan's Prime Ministor Shinzo Abe agreeing to purchase $145billion in securities a month but is putting the program on hold until January of 2014. Abe is trying his best to end stagflation-deflation in Japan with a target of 2% inflation “at the earliest possible time” with an open-ended buying program. Because of this the Yen is up to 88.50 per dollar as of this writing.

Stocks

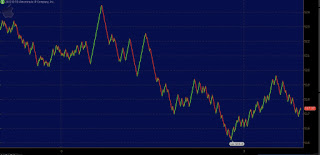

Shares of DuPont are higher to 48.21 in pre-market trading after the company reported better than expected EPS of 11 cents per-share up from the 7c a share expected. Shares of Johnson & Johnson are lower to 72.35 after trading as high as 73.74 in early trading.

Apple shares are back at the 500 level on the nose as its shares fell from 503.75 in early trading. Due to the magical close @ 500 on Friday's January opex you can expect a break of the 500 level to cause selling into 498, over 504 means 510 based on prior trends.

Bonds are lower with the 30 year down 0.28 percent or 12 ticks to 145'15, below 145 means further downside into 144'17 over 145'25 could pressure sellers to cover into 146's.

Commodities

Crud futures are lower by 0.05% to 95.99 after trading as high as 96.20 before falling to 95.50 support before bouncing back over 96. Under 95.80 = 95.60 over 96.20 = 96.50. Gold futures are in the green up 6 points to 1693.30 or 0.38 precent after falling to 1689.30 which puts the 1700 resistance level in play, over this level surely will trigger buy stops. Gold under 1688 could push lower into 80. Remember always have a plan

Links

Sign up for the Trade for Profit Insider

Investors most bullish in 3.5 years according to a Davos Poll

Apple may face first profit drop in 10 years

Atari files for bankruptcy in USA