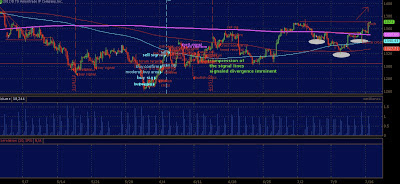

blah blah blah... u know the drill i see a inverse H&S with the head being 1320 and shoulders 1360-71.. if we break out tonight.. tomorrow.. 1400 could be in the cards.. crude's resilience over the 89 level helps the upside thesis also euro failing moving higher post close of europe..

anyway.. we all know this can change on a dime.. this is why you trade what is in front of you and not what u think will be in front of you... below 1355 if this formation fails could et drily into 1340..

be sure to check out Trade For Prof.it ... futures discussion around the clock..

Wednesday, July 18, 2012

4 hour $ES_F chart update

By Sell Puts 7/18/2012 07:49:00 PM