Friday, September 30, 2011

LATE Friday S&P500 5min Chart(s) (SPY)

By Hedge Ly | 9/30/2011 02:18:00 PM |

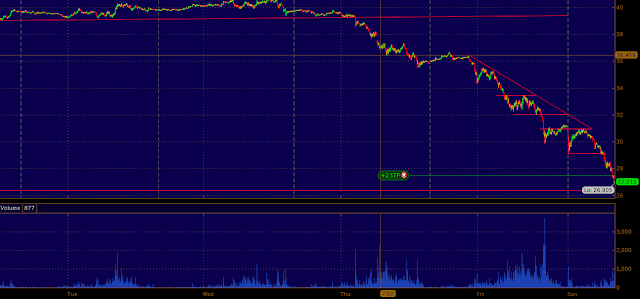

Slow grind down today after yesterday afternoons typical squeeze higher which amounted to nothing but an opportunity to get short. the downside lines of the triangle are in yellow... the hypotenuse is becoming elongated as the price nears the apex.. this usually mean a break out is soon to come.. either down or up.. i feel down 1125 and below means 1110.

Crude oil below 80 was signaled yesterday by the steep ranges and refusal to stay over 83. Equities followed as the DX pushed back over the 79 level.. over 79 equites and crude feel the heat.

Crude oil below 80 was signaled yesterday by the steep ranges and refusal to stay over 83. Equities followed as the DX pushed back over the 79 level.. over 79 equites and crude feel the heat.

|

| 15 MIN inset and 5 min larger ES_F .. |

Thursday, September 29, 2011

Thursday Evening S&P500 Chart 5min (SPY)

By Hedge Ly | 9/29/2011 08:48:00 PM |

|

| ES 5 min |

Silver and gold are trading inverse equities and crude. Watch for the 82 level to possible break on the downside.. over 83.5 CL could hit some buy stops. Gold over 1645 could trigger more stops.

Morning S&P500 Equity Index Future Chart (SPU)

By Hedge Ly | 9/29/2011 08:47:00 AM |

|

| 5 min.. |

sure enough the 1170 area was a pivot which collided with the resistance of the wedge.. dotted line..looking at the 1157 level as it is sticky.. we stay below market could stay offered.

Up UP and away best sums up the price action leading up to the cash open.. some how we managed to run up 1.45% post a 37k decline in jobless claims.. woo freaking hooo..yesterday the 1165 leve presented support and 1175 was the tipping point for selling post left BAT wing.

With just about all futures and commodities trading in line with each other this morning you can expect some unexpected moves in today's session. High correlation going into cash open = looseness.

Crude has moved from 81.25 to 83.52 in about an hour so thats normal ya know, with all these huge changes in the supply/demand curves on a minute to minute basis.

Over 1168 we could see buy stops up to 1180 or 1185. Those levels fails we could trade back to 1160. pick your spots..

Wednesday, September 28, 2011

Another Bat In the S&P500 Has Been Captured - Bat Wing Formation (SPY)

By Hedge Ly | 9/28/2011 11:21:00 AM |

Tuesday, September 27, 2011

Monday, September 26, 2011

Sunday, September 25, 2011

Friday, September 23, 2011

Back in The Channel Again - 21% Gold Margin Hike (GLD)

By Hedge Ly | 9/23/2011 05:52:00 PM |

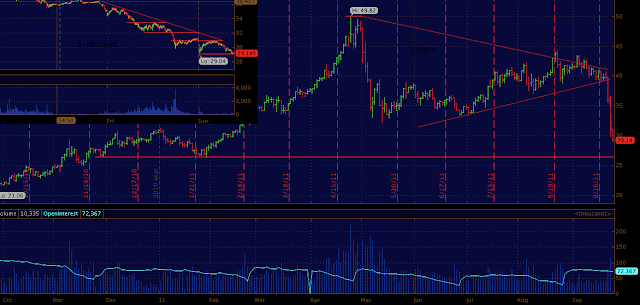

|

| GOLD daily.. and 30 min inset - notice the price fell straight down to the lower up-trending line 1635ish. this trend was last test in mid july.. only to recover. |

. Someone got wind say... 70 GC points ago? Guess the CME needs to figure out who is leaking their oil because the crank case is gonna burn the hell up.

Thursday, September 22, 2011

Tuesday, September 20, 2011

Late Day S&P500/Apple Correlation Update (AAPL)

By Hedge Ly | 9/20/2011 02:35:00 PM |

|

| 1 min CL ES APPLE GC |

Crude under 86 this early morning to over 87.70 as apple topped out @ 422.86. From this point on the market melted lower as the dollar firmed up and Gold quieted down over 1800 but under 1810. I still feel over 1811 GC will see quiet a pop, sustained? i am not sure but seems to be pent up potential energy under 1810.

As for the ES_F we came in down substantially after the Italy downgrade rallied through the early morning hours during china and asia then took out all the sell stops under 1200 before it rallied all the way back to 1214.5. this HI coincided with APPLE's new all time high. 1200 is physiological level thus im sure it will be on our charts for some time.

SINA is loose.

Monday, September 19, 2011

Monday Evening Post Italy Downgrade Emini Chart (SPX)

By Hedge Ly | 9/19/2011 08:09:00 PM |

You can see the pretty tame candle from 1197.75 down to 1185.25 as the Italy downgrade news hit the wires... We are following the same lines which were in play during the regular session.

1190 is (was)a sticky area with 1195 being an overhead level of resistance. over this level 1200 in cards.. below 1186ish could bring in some sell stop probing... long night ahead..

1190 is (was)a sticky area with 1195 being an overhead level of resistance. over this level 1200 in cards.. below 1186ish could bring in some sell stop probing... long night ahead..

Crude played games today and really did not lead the market anywhere during regular session today, though tonight crude is remaning strong around the 86 level.. mean reversion, crude's price always seems to meet in the middle of the day's range. Which is roughly 86. Gold hanging tough over 1780 level.. which was a level where there was quite a fight in the regular session.. above bullish .. below bearish.. gold moves in spikes remember.. the dollar gap up again has the same feel as sunday evening..

Friday, September 16, 2011

Thursday, September 15, 2011

Research In Motion Misses Earnings (RIMM)

By Hedge Ly | 9/15/2011 03:20:00 PM |

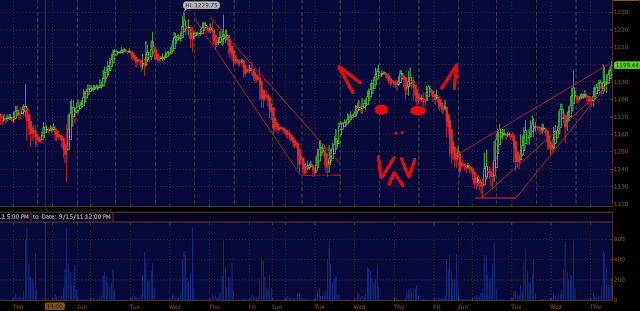

hey hey hey.. goodbye.. you could see this coming a mile away..

Research in Motion sees Q3 adjusted EPS $1.20-$1.40 vs. consensus $1.36

Sees Q3 revenue $5.3B-$5.6B vs. consensus $5.27B. Sees Q3 gross margin approximately

Research in Motion reports Q2 adjusted EPS 80c vs. 87c |

|

| Reports Q2 revenue $4.20B vs. consensus $4.47B |

|

Research in Motion sees Q3 adjusted EPS $1.20-$1.40 vs. consensus $1.36

Sees Q3 revenue $5.3B-$5.6B vs. consensus $5.27B. Sees Q3 gross margin approximately

A 5 Minute Look At The S&P500 Futures (SPX)

By Hedge Ly | 9/15/2011 09:25:00 AM |

same lines different day different break out. 1200 here we come... maybe we see 1220 today... or will reality set in after this 4 day bender of buying? 1190 is a support level that is key, below we could see 1180 quick, god forbid........ When the fed is in charge there are no hangovers. Philly Fed came in negative.. BUT of course it has a positive spin..

"The latest Philly Fed index came in a little worse than economists expected, but not as bad as its awful reading in August" - WSJ

"The latest Philly Fed index came in a little worse than economists expected, but not as bad as its awful reading in August" - WSJ

|

| 5 min ES_F |

Netflix Lowers Subscriber Outlook - (NFLX)

By Hedge Ly | 9/15/2011 08:33:00 AM |

No surprise here...but what does that matter the market is up for the 4th day in a row.. Europe is saved.. buy everything.

()The company, which separated its streaming and DVD-by-mail services two months ago, said Thursday it now expects 21.8 million subscribers for its streaming-only service and 14.2 million subscribers to get DVD plans. That's down from a late July estimate of 22 million streaming customers and 15 million DVD subscribers. It sees the most subscriber decline in DVD-only plans. That forecast went to 2.2 million from 3 million.

|

| 30 min ES |