5 hours ago

Wednesday, November 30, 2011

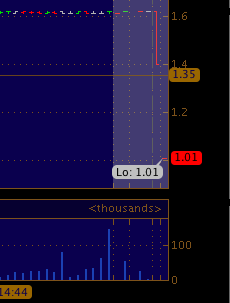

Post Global FX Intervention S&P500 Futures Chart

By Hedge Ly | 11/30/2011 08:53:00 AM |

|

| 1 min |

If we break over 1234.5 we could see 1240 based on chasing momentum .. volume POST the intervention is tepid at best.. a bit over normal but nothing crazy.. still not enough market participants left to move a market huge during cash.. just not enough players outside the big desk who we all know now are in collusion.

Tuesday, November 29, 2011

Post S&P Downgrade of Major Bank S&P500 Futures Look

By Hedge Ly | 11/29/2011 05:49:00 PM |

|

| 5 min ES.. |

1189 is the lind in sand... the low's we are sitting on in the overnight session are indeed the lows which we sat on during cash session.... Gonna be another long night.. keep eyes again on the dollar... and of course the euro.. CL is indicating some weakness under the 98 level.. again 100 fail to hold for a open pit session... even though the mid east is up in arms... the markets are unsure and dangerous.

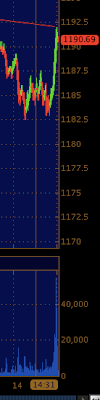

Post Consumer Confidence Blow Out S&P Futures Look

By Hedge Ly | 11/29/2011 09:37:00 AM |

|

| 5 min |

The high is 1206 and the low 1190.25 of cash session.. again as i mentioned earlier the 1190 - 1200 range will be the range until the ball misses the paddle on either side...

notice the amplifying pattern in the chart above.. if it continues we could see a reaction up into 1208 which is the upper resistance to the megaphone pattern.. Which when this particular pattern terminates.. it usually i bearish.. because of indecision .. .

|

| 1 min ES |

Pre Open S&P500 Chart - 1206 High print (FBOOK)

By Hedge Ly | 11/29/2011 04:39:00 AM |

|

| 1 min ES |

1.75c move in about hour and 15 min.. not bad for pre market..

|

| DX vs 6E |

Monday, November 28, 2011

Late Night S&P500 Chart (SPY)

By Hedge Ly | 11/28/2011 11:11:00 PM |

|

| 51 min ES_F |

could be another day like monday setting up for tomorrow...

Post Close Charts & Musings (SPX)

By Hedge Ly | 11/28/2011 06:11:00 PM |

|

| 15 min ES_F |

The fade from highs today was almost a gimmie trade though it took much patience in gauging the price action up into the 1196.25's... the action was lethargic and sporadic at best. The dollar from the moment cash open saw a consistant bid all the way up to 79.48 which coincided with ES testing the opening cash range of 1182.5 .. twice. kabash.

The closing print shenanigans was nothing more than games to get individuals to puke positions. It worked. Euro still falling into 1.33 ... Crude is down .7% @ 97.54.. remember 100.74 printed this morning... Thin markets = wild moves.... If the magic euro crosses 1.33 and stays below look for equities to give up the bacon... Crude already lead us up friday.. and is foreshadowing at possible weakening/profit taking in the euro tonight...

|

| 1 min ES |

Spin The Bottle - European Sovereign Debt Edition

By Hedge Ly | 11/28/2011 05:54:00 PM |

Spin the Bottle

-Jeff @thekillir Kilburg

Sr. Development Director at Treasury Curve

We all remember the game of risk that involved spinning a bottle in junior high. Unfortunately, over in Europe there are 17 participants with one member looking a bit worse for the wear than the next.

We have seen Portugal, Ireland, Italy, Greece and Spain in quite a puckered state during the past year but, our concern is now cast upon the core.

Last week, Germany saw for the first time in quite some time a failed bond auction.

What does this mean? They simply could not sell the debt they designated to sell for that specific auction.

Specifically, they were only able to ascertain about 3.8 billion worth of bids for the 6 billion they wanted to unload. This makes some think that this European crisis could be rotten to the core, pun intended.

Subsequent to this auction, we witnessed the disparity between U.S. government 10 year yields and German bund yields widen to an uncomfortable level alarming those that look to the fixed income markets for leadership...like myself.

We have seen Portugal, Ireland, Italy, Greece and Spain in quite a puckered state during the past year but, our concern is now cast upon the core.

Last week, Germany saw for the first time in quite some time a failed bond auction.

What does this mean? They simply could not sell the debt they designated to sell for that specific auction.

Specifically, they were only able to ascertain about 3.8 billion worth of bids for the 6 billion they wanted to unload. This makes some think that this European crisis could be rotten to the core, pun intended.

Subsequent to this auction, we witnessed the disparity between U.S. government 10 year yields and German bund yields widen to an uncomfortable level alarming those that look to the fixed income markets for leadership...like myself.

Mid Day S&P500 Futures Chart

By Hedge Ly | 11/28/2011 01:19:00 PM |

|

| 1 min ES |

98.5 was a big support level in CL which showed quite a bit of volume when it broke.. now is minor resistance .. along with 1194 ES.

Jack in the box.. market goes down but someone is always turning the crank....

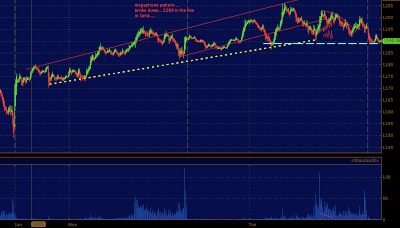

Flying Triangles - S&P500 Futures Chart

By Hedge Ly | 11/28/2011 09:00:00 AM |

|

| 5 min |

anyway you can see how we ran into 1170 and broke higher.. rand into 1178 broke higher .. ran into 1190 and broke higher.. all ascending triangles.. Crude is selling off a bit and ES is now up 3.5% .. seems we are getting a bit ahead of ourselves... if the 1195 area fails we could trade sideways until we test 1200.. which was last seen monday of last week...there is a lot of air below this helicopter..

Saturday, November 26, 2011

Weekend S&P Futures Look

By Hedge Ly | 11/26/2011 03:51:00 PM |

|

| 5 min ES |

These melt up's create great set ups for a fundie or three to open shorts into... and then cover 20 handles later.

1170 - 1145 is the range to watch for sunday open... above 1165-1170 we could see a nice bounce.. under 1150 we could see more red and a probe of lows..... August lows are not to far away...

|

| 1 min CL/ES * worth noting ---- Funny how crude moved in the exact opposite direction of the index's into the 30 min of trading... |

Friday, November 25, 2011

Thursday, November 24, 2011

Late Night S&P500 Chart (SPY)

By Hedge Ly | 11/24/2011 07:37:00 PM |

|

| 5 min ES |

if 1153 breaks we will see 1150 .. and if that cracks.. it could be a quick move to august lows.. which will be a the 4rd major test of 1100 level....1168 is the LOW for the DEC es contract.

Today's Updated S&P500 Futures Chart

By Hedge Ly | 11/24/2011 05:05:00 PM |

|

| 5 min ES |

The price action today included a failure to hold highs of the session much like this past tuesday and wednesday's price action.

The Euro still weak with the 1.33 level as major support.....

Wednesday, November 23, 2011

Mid Day S&P500 Chart (SPY)

By Hedge Ly | 11/23/2011 11:49:00 AM |

|

| 5 min ES |

Crude popped quite a bit off lows as inventories saw a draw. But its only a fade ... if euro weakness continues...

|

| 15 min ES |

Tuesday, November 22, 2011

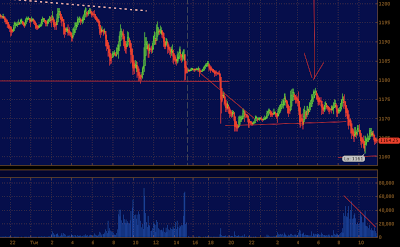

Tonights S&P500 Chart. Post Breach 1180 (SPY)

By Hedge Ly | 11/22/2011 08:22:00 PM |

|

| 5 min ES |

"Now that the 1200 metric is in the rear view (for now) we are staring at the 1179.25 level as the lower line in the sand. If we trade and hold with conviction under this metric another 10 handles of sell stop air pockets could be triggered. "

Pressure is on as the dollar rises into the 78.60 level, once over 79 there will be a great deal of momentum. If this does indeed happen as the euro crisis deepens 1150 could be tested in short order... If 1150 fails we could fail to 1100. Trade it day by day but have a roadmap. We could very easily bounce a bit. but it does feel different this time around.

commodities overnight are confirming equities weakness.

Post Late Session Sell off S&P500 Futures Chart (SPY)

By Hedge Ly | 11/22/2011 04:13:00 PM |

|

| 1 hour ES |

Trading on a intra-day basis is becoming harder and harder as moves become more erratic and violent in either direction.

I am still a believer in coming in with a clean slate, though getting up early or staying up late is advised if you want to get a solid feel for the overnight price action. Intra session a lot of the prices which are 'sticky' were prices which overnight saw volume print.

Keep watching the dollar.. it is still firm. and any wimper out of the euro zone will indeed send the dollar higher and equity markets fumbling.

Keep watching the dollar.. it is still firm. and any wimper out of the euro zone will indeed send the dollar higher and equity markets fumbling.

Post MF global has created an environment where many traders are still unable to trade who were active and willing participants a month ago... The destruction of the capital markets is alive and well....Good work jonny C.

Monday, November 21, 2011

Late Session Crude Chart - Post Iran Headline (USO)

By Hedge Ly | 11/21/2011 02:52:00 PM |

|

| 5 min cl ... |

S&P500 Futures Morning Chart UpDate

By Hedge Ly | 11/21/2011 09:02:00 AM |

|

| 5 min ES |

Saturday, November 19, 2011

Friday, November 18, 2011

Thursday, November 17, 2011

Crude Squeezing Up As The Dollar Backs Off

By Hedge Ly | 11/17/2011 08:31:00 PM |

|

| 1 min CL |

as for crude.. the 99 level is magnetic... pressure is lightening up as the dollar falls. buyers moving back in to gold as well... ebb and flow... i think the 4% down move in crude today was a bit over done.. and smelled fishy.

notice the break of the trend line i highlighted...

|

| DX 5 1 min |

Pre Close & Post Break of 1220 "line in sand" S&P Futures Chart

By Hedge Ly | 11/17/2011 02:03:00 PM |

|

| 30 min ES.. |

refer to my previous post today, time stamped. Check the "line in sand"

|

| 5 min ES |

Mid Day S&P500 Future Chart

By Hedge Ly | 11/17/2011 11:24:00 AM |

The dollar is still firm over 78.20 and crude is still out in left field .. it is a train running without a conductor .... 1220 was the ES low this morning.. and that was NOT random.. take a look at my previous days tech and notice this yellow dotted line has been in play for over a week..... beige dotted line no medium term support...... below 1220 the market will buckle...

|

| 5 min ES |

Wednesday, November 16, 2011

Post Late Session Sell off S&P500 Futures Chart (SPY)

By Hedge Ly | 11/16/2011 04:44:00 PM |

|

| 30 min ES_F |

|

| 15 min ES_F |

The S&P's were spooked as the cash markets came to a close, perhaps by fears another Arab spring? or is something else brewing because the financials were getting ROCKED. GS trading with a 95 handle.. Morgan down nearly 8 percent...

Perhaps the skeletons are going to start talking soon?

That being said you can see the the yellow dotted line which as been overhead resistance this whole week was tested again, and again failed this afternoon.

As i mentioned in my video's i like the S&P long OVER the 1260 metric because if we DID trade over the yellow line it would take some serious buying. That buying never showed up and the volume was all on the downside once again.. Participants wait, then pounce. 1228 was the low so far this evening as the dollar pushed up near the 79 level.

Crude on the other hand remained bid and failed to give up much ground, firmly planted over the 101 level.

Post Pit Close Crude Chart (USO)

By Hedge Ly | 11/16/2011 02:00:00 PM |

|

| 1 min CL |

Again the dollar remains strong. despite what is going on in the equity markets which are basically in drift mode waiting for some europe resolution.

Back In The Channel - S&P500 Futures Look

By Hedge Ly | 11/16/2011 12:17:00 PM |

Volume again rather low(ish) intra session.. the real volatility was in the early morning europe trade and the hours before pre cash US session. the 1255 -1240 channel is where the price is currently.. above 1260 i still think we could see some upside.. though since the 1254's failed last night the bears are in control under 1255. Oil is off in left field and the rubber band is stretched.

|

| 5 min ES |