|

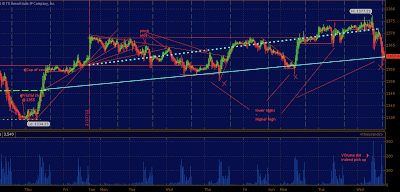

| 15 min ES. Notice light blue dashed line. held. WICK though. |

1. Bonds broke down with equities

2. S&P & NDX took out previous day lows

@ US Dollar futures reared their ugly head instantly sending the commodity complex sharply lower. Gold and silver saw the greatest sustained selling pressure, gold was off 100 points from opening prices at it's worst level..eventually basing around 1690 (i like it long over 1700 into tomorrow)... Silver also fell considerably. I am in the camp silver finds a bid into thursday as well

|

| NQ highlight of chart price action |

Equity index's also gave a clear sell signals shortly after dollar began rising, what i noticed was a simple chart breakdown and some funky quotes. The violence at which NDX reversed after failing to make a new high over 2645.25 was my first signal. The second signal was the break of 2635. By this point, apple HPQ (weak all day) and AMZN were already nearing lows; thus i lift the the offer on the 1 strike OTM NDX put.

The hedge worked as the NDX fell below 2625. I alerted on twitter numerous times, as well as in the live forum i moderate; i am adding

I added calls in both SPX and NDX in the final minutes of the extended cash session after paper pushed the ES down 10 handles on the close. The calls are weekly and premium risk is minimal.

105.50 level eventually finding a bid @ 104.84. This level eventually became the head of an inverse H&S. shoulders being 105.75.. the price lifted out of the right shoulder into 106's forming a consolidation pattern before the a squeeze into floor close sent prices over 107.10.

|

| 5 min zoomed ES.. notice reaction to light blue line b4 Afternoon sell off |