|

| 15 min ES. note the V |

What goes up must come down? ...the dip buyers were back in force today, but a bit trigger shy as the bears gave up over 1494 as buyers slowly moved back in.

The

ES rose from 1494.50 all the way back to 1506.75 before falling back to around 1506 were the futs currently sit as of this writing.

DO or die

ES must hol 1490.25 if 1494.50 fails or its 85-70 ES quick.

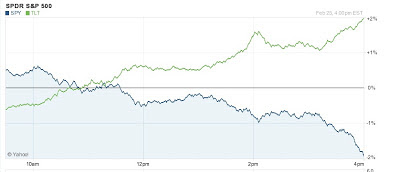

The force behind today's dip, bond strength. at least that is what the correlation told me. Maybe some other force is beyond the trade i dont know and i dont really care because the charts said bonds were bid and equities were simultaneously offered as we noted earlier in the day. Once the

bond bid subsided equities came back about an hour after the open.

|

| 30 min ES. note rising volume the past 2 weks |

The

NQ had a wild range trading up into a 2748.75 high off the open then falling to 2712 then bouncing in the last hour after

Apple released a note acknowledging

investor cries to return cash to shareholders.

Currently the

NQ sits @ 2744.75 with a slight bid 2750 is a possible pinch level up out of a inverse H&S with 2712 being the head.

What a difference a day makes... not really.. but the Spooz did belch lower through the all important 1510 level in the minutes before regular session closed today.

What a difference a day makes... not really.. but the Spooz did belch lower through the all important 1510 level in the minutes before regular session closed today.