|

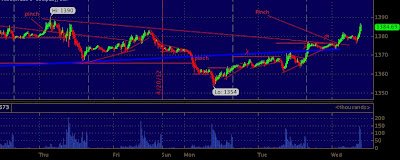

| 6E - notice the reaction off 3.16 ... not mom and pop. ----- watch the Japanese yen ... flat fter steep losses |

|

| ES 5 min |

|

| 6E - notice the reaction off 3.16 ... not mom and pop. ----- watch the Japanese yen ... flat fter steep losses |

|

| ES 5 min |

|

| 1 min ES .. |

|

| 30 min CL - notice the 105 level... if taken out........ 105.50 |

|

|

| tomorrow the ES will probably be within the box |

|

| 15 min ES |

|

| 15 min NQ |

|

| 5 min ES |

|

| 30 min NQ - notice the red line overhead bet the price may pinch over this level...the question is will it hold? |

|

| 5 min ES |

|

| 5 min NQ futures.. the large candle on left is Apple EPS release. |

|

| 1 hour AAPL |

|

| 4 hour AAPL - notice the 550 level |

|

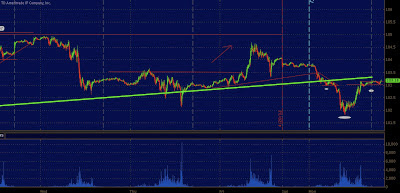

| 30 min ES ( notice how the up-trending green line was a magnet.. now it is resistance/could turn support |

|

| 5 min NQ futures- the price consolidated into an APEX.. the BOOM. break out.. |

|

| 5 min ES |

|

| 5 min ES |

|

| 5 min CL .. Easy to see inverse H&S |

|

| 30 min CL .. notice the bullish move off the 102 level "V pinch" |

|

| 4 hour ES_F - notice 1340 level @ dotted vertical line |

|

| 5 min ES |

|

| 5 min ES |

|

| 30 min ES |

|

| AAPL 30 min |

|

| daily MSFT |

|

| 1 hour MSFT. notice the break out/rising triangle @31.6 |

|

| 1 min AAPL |

|

| Goog 5 min |

No content provided within the pages of "hedge accordingly" or "HedgeLy" "trade for profit" constitutes investment advice. Neither Hedge Accordingly or it's authors offer advice or recommendation to buy or sell any security. "Hedge Accordingly" is not a financial advisor and does not recommend the purchase of any stock, option, futures contract or offer advice on the suitability of any trade or investment. Actions you take as a consequence of any analysis, opinion or advertisement within the pages of Hedge Accordingly are your sole responsibility and at your discretion. Any content is to be used for educational purposes only.

Any links provided here to other web sites are for informational purposes only. We take no responsibility for the accuracy or content of linked sites. -Contact -