|

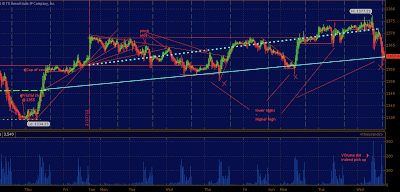

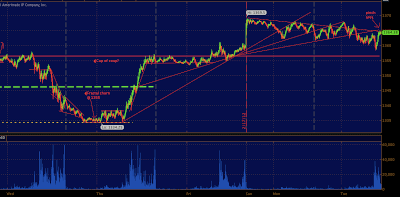

| 5 min ES |

Looking back to my S&P post from

earlier today i mentioned the spooz needed to climb over 1365 to convert into a test of 1370's. This, of course, did not happen and the price failed into the Thursday's closing 1354.75-1355 area.... 1355's were bought and we bounced into 1360. 1360.50 is where the spooz sits as i type.

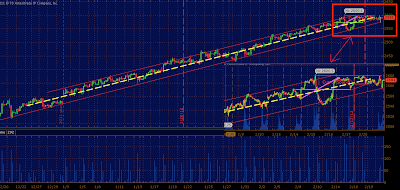

Today's trough to trough (open to close) range was 2nd largest in almost 2 months & the vix barely moved over 18.50 (18.19 closing price). This explains a lot of the complacency on either side of the market. Bulls or bears are still locked up waiting for the official to tell the to back up and fight. For the last month any upside breech's of highs made during AH globex have been promptly sold off during the cash session. Though any sell off during cash is mitigated by the end of the day.

|

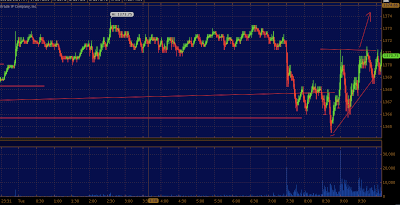

| 30 min ES. Complacent pattern |

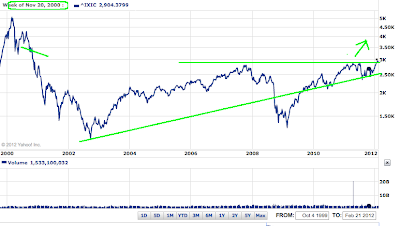

This pattern cannot go on forever but will remain in place until the large cap index components start breaking into new territory. Tech led the last 3 month move (out performing the S&Ps on a % basis) and has failed to make a new high with the S&P's.

Perhaps the NDX is being held back in hopes the S&P's will catch up and profits/new positions can be established in the likes of ...IE apple amazon and google; which have struggled with their footing each and every time mother index (NDX) reached 2600.

|

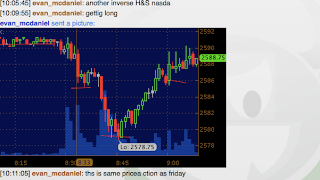

| 1 min NQ (nasdaq future) |

I made 1 trade today. I added NDX 2650 calls and SPX 1380 calls with underlying @ 2576. What caused me to arrive at this decision to trade?.. the way the NQ's reacted off 2574.5.

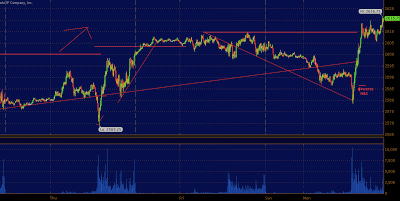

Iran worry and Greece summation pushed crude oil over 106$ a bbl.

Yes is an issue.. but.. In October of 2008 CL high was 95 a BBL. with the S&P's trading between 1492 - 1586; the DX was trading at the nearly the exact same level then as today; the 30 year around 115.

CL has a bit of room to run without hampering equities..