5 hours ago

Tuesday, January 31, 2012

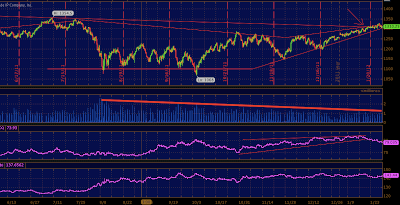

Mid Day Light Sweet Crude Chart

By Hedge Ly | 1/31/2012 12:05:00 PM |

|

| 5 min |

Worth noting the volume in the 5 minute period where crude failed 99.75 down to the 98.80 area over 13k contracts trades. Fairly high volume and above average going back a few weeks.

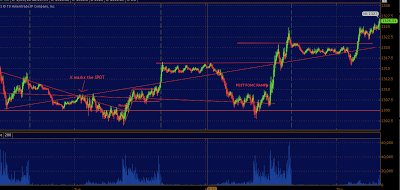

10 year look at Radio Shack (RSH)

By Hedge Ly | 1/31/2012 09:56:00 AM |

10 years of disappointment and margin erosion by the big box competition has done a number on RSH share price... below 7 bucks this thing could see 5 and lower.. in the past 3 years there has been quite a bit of 'rumor' about a takeover or private equity in this name, nothing has materialized but lower prices.

|

| monthly RSH |

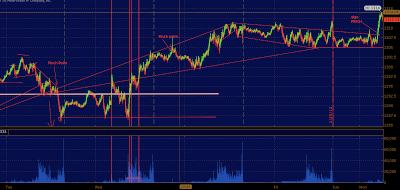

Monday Morning S&P500 note

By Hedge Ly | 1/31/2012 08:45:00 AM |

|

| 5 min ES... post PMI sell off.. |

|

| 5 min ES |

on the downside 1310 is immediate support. below we are back to yesterdays territory. 1305

CL bid over 101.39 .. 101.29 is the day high...

remember.. today is the last day of January.. window dressing perhaps..

Friday, January 27, 2012

1309.75 "pinch" - Afternoon S&P Note

By Hedge Ly | 1/27/2012 12:50:00 PM |

I am very disinterested in the current market; recycled headlines et al. Anyway the S&P future contract saw rising prices throughout the morning; from 12 am or so until cash open... and again after cash open (almost identical to yesterday); the price sold off 10 handles.. from 1317's to 1307. The overnight low broke without hesitation, yesterday's lows below 1305 were not tested..... Thus making 1307 the line sand

|

| 5 min ES |

Thursday, January 26, 2012

Last hour S&P500 Future Update

By Hedge Ly | 1/26/2012 02:01:00 PM |

|

| 5 min ES |

very slow slide today.. lots of panic for only a -.6% day.. but remember we did gap up nearly .5% .. we are down 18 handles now from highs.

Quick S&P500 Chart update

By Hedge Ly | 1/26/2012 09:59:00 AM |

|

| 5 min ES |

1320 broke.. if 1319 fails.. 1315 and we languish most of the afternoon until the close IMO.

Wednesday, January 25, 2012

Post FOMC S&P500 Note -

By Hedge Ly | 1/25/2012 02:09:00 PM |

Updated S&P chart below.....

|

| 1325 reached . 1327.5 traded 1/26/12 |

|

| 5 min ES . notice how many trend lines are still dictating pivots |

The centrally planned and centrally controlled market will only go in one direction, without QE UP.... because apparently all the market needs to move higher is synthetic ETF QE administered via individual stock arbitrage creating what looks like buyers and sellers.. when in reality it is a game of hot potato between HF programs..

Anyway, from the 5 min chart above you can see the violence of the moves during cash sessions, including today's buying frenzy. Monday and tuesday the futures looked curiously weak until around 5 am in the morning when the machines stepped in taking prices vertical.

What makes this morning's trade different was we had weak equity futures from Asia open until about 15 minutes after CASH opened, then buyers stepped in around 1302 melting the price higher into FOMC.. once FOMC hit futures lifted from 1308 until 1320.75.. simple right.. WE could easily see 1325 if the momentum continues. Looking like by march we will be clear above 2011 highs...

|

| example of ETF correlation ...FXE and EDC .. exact same chart.. |

Trade what you see and not what you think.

Tuesday, January 24, 2012

The Auto Pilot Market - Afternoon S&P Futures Note

By Hedge Ly | 1/24/2012 01:20:00 PM |

Lets hope the GPS driving today's trade is not one used on cruise ships... or actually yes.. that would be good.

no test of highs today, yet.. though the perma bid over 1305 still exists and you can lean on it carefully if you choose to scalp long. You can see where the price pinched as cash markets opened @ precisely 1305.

Over 1310 buy stops.. below 1305 we see 1301 again.. last week i mentioned i welcomed a test of 1300 before we moved higher, if indeed this is the trend... the low today 1301.75 just might have been the test of 1300. If that is the case 1320 in the deck later this week.. if the market will ever wake up again.

|

| 5 min ES |

Over 1310 buy stops.. below 1305 we see 1301 again.. last week i mentioned i welcomed a test of 1300 before we moved higher, if indeed this is the trend... the low today 1301.75 just might have been the test of 1300. If that is the case 1320 in the deck later this week.. if the market will ever wake up again.

Monday, January 23, 2012

Chesapeake Cuts Production. Will other producers follow suit? - Rig count (CHK)

By Hedge Ly | 1/23/2012 06:17:00 PM |

|

| 5 min CHK |

The price throughout the day rose from from 2.31 to 2.619 and the (semi) popular ETF UNG up some 9% ....

According to Tudor Pickering: "Significant gas activity declines are necessary for improvement in supply fundamentals and view reductions (-163 rigs since Oct high) as step in right direction."

As you may or may not know the price of natural gas futures are down substantially since they last saw a sharp spike in 2008. The drop in price can be explained in simple supply and demand terms.... greater and greater capacity has come into the market as shale gas and liquefied nat gas production has boomed while demand has remained constant...... this is the driving force behind pushing prices lower and lower.

The million dollar question is will Chesapeake's competitors follow suit with production cuts or will CHK remain on it's own. IF other major US producers follow suit you can surely bet on much upside in nat gas prices, especially if last portion of winter and spring is cold.

More longer term speaking..upside in a Nat gas prices can be bolstered if current US energy policy rhetoric hints at utilizing our vast reserves of nat gas...or more cuts cuts...

If i remember right i tweeted a few weeks ago.. "we have a lot of nat gas, its time to start using it" - time to start thinking about the above paragraph becoming a reality.

There is so much gas they are shutting in production.. wake up washington.

|

| 1 min NG futures.. more upside into 3.20 if this triangle holds |

The million dollar question is will Chesapeake's competitors follow suit with production cuts or will CHK remain on it's own. IF other major US producers follow suit you can surely bet on much upside in nat gas prices, especially if last portion of winter and spring is cold.

More longer term speaking..upside in a Nat gas prices can be bolstered if current US energy policy rhetoric hints at utilizing our vast reserves of nat gas...or more cuts cuts...

If i remember right i tweeted a few weeks ago.. "we have a lot of nat gas, its time to start using it" - time to start thinking about the above paragraph becoming a reality.

There is so much gas they are shutting in production.. wake up washington.

Light Sweet Nearing Pinch Point @ 99.95 (USO)

By Hedge Ly | 1/23/2012 05:33:00 PM |

|

| 5 min |

two things can happen..

A. CL will break out of the formation over 100 and melt up into the evening hours...

B. 99.80 fails and we see a test of 99.50

|

| 1 min CL |

Monday Morning S&P500 note

By Hedge Ly | 1/23/2012 06:05:00 AM |

1318.25 traded on a reach into buy stops and failed violently down to 1305.25 ... refer to my morning post from 6am below.

If you went to bed at a reasonable hour you saw red futures, this (anomaly) did not last long... the ES is currently green as well as crude. Some eurozone talks on the 'crisis' apparently sparked the algo's into buying over 1310 sending the ES up to 1314, a new 2012 high! 1305 held firm throughout the night thus during cash and the hour leading up 1305 will need to hold to continue upside. below could trigger 1300 test.

The euro is up .6% sitting with the high of the session being 1.3017... as you remember a big break down point for the euro was 1.3 failure..

|

| 5min ES.. |

|

| 5 in ES |

The euro is up .6% sitting with the high of the session being 1.3017... as you remember a big break down point for the euro was 1.3 failure..

Friday, January 20, 2012

January OPEX S&P500 Futures Note

By Hedge Ly | 1/20/2012 01:20:00 PM |

|

| 5 min ES |

the line in the sane for today in the ES is 1305, you can see how the uptrending support line from two days ago converges with today's support. If the channeling pattern which indeed is sloping downwards continues 1305 could fail. I welcome a re test of 1300, but i welcome anything today to shock the markets into moving...

VIX below 19 .

|

| 5min CL |

|

| VIX 5 min |

Thursday, January 19, 2012

Morning S&P500 Futures Chart

By Hedge Ly | 1/19/2012 09:07:00 AM |

Another day, another year high. 1309.25 this time... anyway the overnight session was the one to trade, cash opened crude puked, ES puked rallied, then puked. all in a 5 handle range. Makes you wanna pull you hair out. but whatever.. maybe we will have a red day? god forbid the market falls a percent.

|

| 5 min ES>. still following the resistance |

Wednesday, January 18, 2012

Deal or no Deal - Euro Continues the march towards 1.3 crime scene

By Hedge Ly | 1/18/2012 04:54:00 PM |

Needle Spikes of Buying within Broadening pattern (SPY)

By Hedge Ly | 1/18/2012 12:16:00 PM |

ES Higher highs within the below pattern.. lows held.. bullish yes.. though will the S&Ps fall off 1300 down to 1286.50 (morning support) or test the mid line of the channel 1293? we shall see.... when europe is closed the market behaves a bit more rationally.

NOtice the red vertical time markers.. each marker coincides with a violent spike in buying..

followed by a drop in volume and a drop in price.. it does makes sense here..

more buyers than sellers..but what is funny is how large the volume spikes

are compares to average 1 min volume excluding the large vol spikes...

|

| 5 min ES |

NOtice the red vertical time markers.. each marker coincides with a violent spike in buying..

followed by a drop in volume and a drop in price.. it does makes sense here..

more buyers than sellers..but what is funny is how large the volume spikes

are compares to average 1 min volume excluding the large vol spikes...

Wednesday Morning S&P500 Look

By Hedge Ly | 1/18/2012 08:33:00 AM |

|

| 5 min ES. showing 1287.50 support below will see quick selling into 1285.. that fails.. 1280.. Euro strong like bull over 1.28 |

|

| 15 min CL |

below 100.50 CL could again run to below 100.. if it holds we chop around into new highs..

Tuesday, January 17, 2012

A Monthly Look at Cree inc. (CREE)

By Hedge Ly | 1/17/2012 05:05:00 PM |

|

| CURRENT - Monthly CREE |

|

| Monthly interval CREE |