|

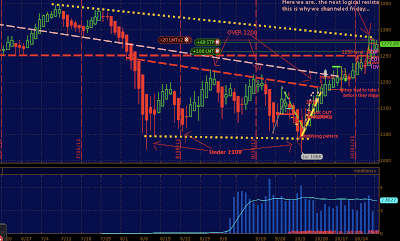

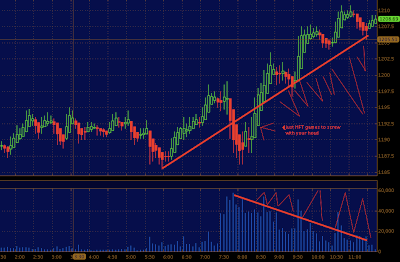

| 15 MIN ES |

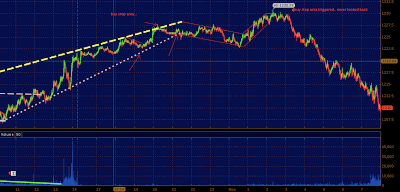

Beyond the news id like everyone to focus level at which the intervention took place in regards to the ES_F. All the powers to be understand the correlations of our markets and ill be damned if they did not pre meditate this "intervention".

The meditation was hit his market where it will cause the most ruckus, that was via dollar. Arb desks blew their positions out and MF global happened to go bankrupt. There are no coincidences. Just keep in mind technical levels in the marked do line up with unforeseen events. The market is seemingly random and indeed it is when the game is not