5 hours ago

Wednesday, August 31, 2011

Tuesday, August 30, 2011

A S&P500 Chart For All The Humans Out There (SPY)

By Hedge Ly | 8/30/2011 06:21:00 PM |

|

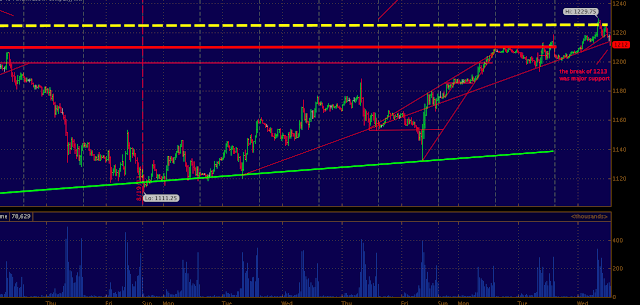

| 4hour |

Anyway we had a upward thrust today in the markets towards 1220 though the machines only managed to get us up to 1218.75. NOtice the yellow dotted line that is the definitive line in the sand, if we break over this level buy stops will be triggered setting off another buy stop orgy, much like the one we saw over 1200. SO the lower line in the sand of the wedge/ascending triangle you can see above is 1140. Max upside if we break over the yellow line is 1300.

|

| 15 min |

Monday, August 29, 2011

Sunday, August 28, 2011

Friday, August 26, 2011

The Rise & Run Of Today's Move = To Steep For Human To climb (SPY)

By Hedge Ly | 8/26/2011 12:09:00 PM |

Thursday, August 25, 2011

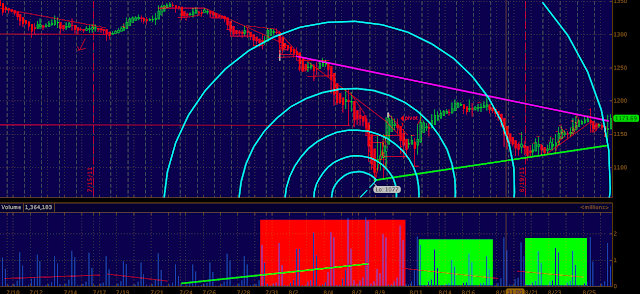

Come on Irene - A Hurricane Is Coming Graphically Speaking (SPX)

By Hedge Ly | 8/25/2011 09:20:00 PM |

Wednesday, August 24, 2011

Late Night Correlation Update - (USO)

By Hedge Ly | 8/24/2011 10:53:00 PM |

|

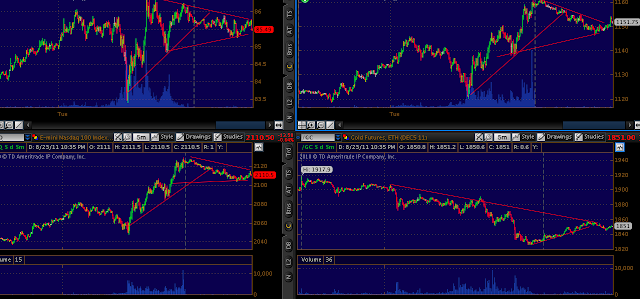

| 5 min |

Low 1744 in GC and 1770 being tonights resistance. The trend line under 1160 in the ES is support for this evening... NQ_F is has lead the other index's the past week up.. with the apple issue tomorrow will be be interesting.. where the index's open is going to be hinged upon where apple indicates tomorrow morning..

Show ME the GOLD Part II (GLD)

By Hedge Ly | 8/24/2011 01:07:00 PM |

|

| 1 min GC |

|

| GLD 5 min showing all time high |

|

| 5 min GC showing all time high and now 103 points lower 1755.5 print |

Tuesday, August 23, 2011

Late Night Correlation Update - (GLD)

By Hedge Ly | 8/23/2011 11:39:00 PM |

Time Machine: A Weekly Look @ S&P500 Futures 1992 to Present (SPU)

By Hedge Ly | 8/23/2011 06:30:00 PM |

The question is will the trend line which started in 1992 provide a level of support or will the headwinds become to great as the machines and federal reserve fail to contain the volatility which you can CLEARLY see in the chart which started in 1994 and is culminating currently.. notice the VOLUME in the ES contract for the year, over 20 million .. this is the first uptick in volume since late 2008 over the 20 million level... and guess what IT IS ON SELLING.. not buying.

I am merely the narrator, you are the trader.

Late Night Correlation Update - is something brewing(USO)

By Hedge Ly | 8/23/2011 12:00:00 AM |

UPDATE:

and YES something was brewing.. which i spotted ... what was brewing as an absolute algo orgy of epic proportions.

-----

Good morning. We have an interesting day setting up tomorrow with China PMI printing 48 which apparently sparked some sort of dormant buyside algo. WE have all major commodities up including crude oil, CORN pegged up on highs, treasury's are down and copper as well as GOLD which is currently at 1907 an OZ.

Perhaps something is brewing for tomorrow, more quantitative easing whispers ahead of the Bernank's speech at Jackson Hole at the end of this week? Or maybe some other happy go lucky not good for the macro scheme of things BS financial trickery. Whatever the case may be, trade this market up and down. Trade what you see, if we rip like a son of a b* go with it, we know the machines are in control .. When the machines see an opportunity to all get on the same page, they can move these markets so fast in such little time its almost magic if you an onlooker..

Anyway.. look for the ES_F to break out of these ascending triangles to the 1135 level.. the ES_F and NQ_F are perfectly correlated .. both up .8% ..

the dollar is quiet and down slightly as of 1 am... though the euro is picking up steam..

what puzzzles me is gold up and holding firm and treasuries still selling off..

very systematic trading tonight.. each new high is bought with very large volume considering time of night and previous 1 min candles.. this goes true for all assets.. money is moving around..

who knows.

and YES something was brewing.. which i spotted ... what was brewing as an absolute algo orgy of epic proportions.

-----

Good morning. We have an interesting day setting up tomorrow with China PMI printing 48 which apparently sparked some sort of dormant buyside algo. WE have all major commodities up including crude oil, CORN pegged up on highs, treasury's are down and copper as well as GOLD which is currently at 1907 an OZ.

Perhaps something is brewing for tomorrow, more quantitative easing whispers ahead of the Bernank's speech at Jackson Hole at the end of this week? Or maybe some other happy go lucky not good for the macro scheme of things BS financial trickery. Whatever the case may be, trade this market up and down. Trade what you see, if we rip like a son of a b* go with it, we know the machines are in control .. When the machines see an opportunity to all get on the same page, they can move these markets so fast in such little time its almost magic if you an onlooker..

Anyway.. look for the ES_F to break out of these ascending triangles to the 1135 level.. the ES_F and NQ_F are perfectly correlated .. both up .8% ..

the dollar is quiet and down slightly as of 1 am... though the euro is picking up steam..

what puzzzles me is gold up and holding firm and treasuries still selling off..

very systematic trading tonight.. each new high is bought with very large volume considering time of night and previous 1 min candles.. this goes true for all assets.. money is moving around..

who knows.

Monday, August 22, 2011

CEO Of Goldman Sachs Retains White Collar Defense Attorney - Reid H. Weingarten (GS)

By Hedge Ly | 8/22/2011 05:36:00 PM |

So if you have not heard yet the captain of the 'empire of squid' has reached out to a white collar crimes defense attorney in what i would guess a last ditch effort to stave off the coming backlash against his wonderful image.

Anyway if you looked at the spooz today you probably could not make anything of the trend pre GS news, though it makes sense now that market was offered down to 1135 then 1125 then 1120 which perhaps was short sellers who were tipped off about the Blankfein news... IF that is the case im sure it was Goldman traders doing what they do best, get news before others and trade in front of the crowd.

Information on his attorney:

Anyway if you looked at the spooz today you probably could not make anything of the trend pre GS news, though it makes sense now that market was offered down to 1135 then 1125 then 1120 which perhaps was short sellers who were tipped off about the Blankfein news... IF that is the case im sure it was Goldman traders doing what they do best, get news before others and trade in front of the crowd.

Information on his attorney:

White-Collar Criminal DefenseMr. Weingarten represents clients in complex criminal matters in both state and federal courts at the pre-trial, trial, and post-trial stages, including cases involving public corruption, the Racketeer Influenced and Corrupt Organizations Act, bank fraud, bribery, government procurement fraud, antitrust, healthcare fraud, and tax and securities fraud.

|

| GS 1 hour. notice descending triangle break down under 110 . previous descending triangle break down was @ 128 |

Head & Shoulders Everywhere. Post OPEX Index Charts (GS)

By Hedge Ly | 8/22/2011 01:46:00 PM |

|

| 1 min |

Today i have been a bit more quiet on the twatter stream because honestly i am really tired of this market and Mr. Puts needs to recharge his battery's before September hits. What to expect in September? More of the same just with a bit more volume and more humans involved..

As for today Looks like the aglo's have a case of the 'Mondays' as Peter's neighbor would say through the wall.. Algo's can see through walls but i think we all wish they would just say hello on the consolidated tape and stop with the BS games. Anyway as you remember Friday was August Opex which was as see saw session that ended up on the red side despite all the gunning from various trader desks all vying for the every elusive yet now 'programmed' pin.

The chart above highlights the anomaly of unrelated assets following each other when graphed pretty much to the T. You can just look at a chart of APPLE computers now and know what the ES_F and of NQ_F is doing. So for all intensive purposes i posted a nice little chart curtesy of TOS charting which aligns the gride of charts quiet nicely. We have CRUDE squeezing over 84 into pit close, (standard manipulation), the S&P500 and the NQ_F are both forming a H & S as well as the big boy APPLE. Apple is the lower right hand corner chart.

Levels of interest in the ES_F 1125 is being defended here, 1111 was the low, 1145ish was the high. 1130 is resistance as well as 2050 in the NQ_F . 2040 is support NQ_F.. if any of these levels are tested you can be sure over resistance and or under support there are buy or sell stops waiting to get ping ponged off of..

and Libya.. who cares.. the market doesnt.. we got bigger problems over in our neck or the woods... and that is the rest of the story.

|

| NQ 1 min |

Saturday, August 20, 2011

Friday, August 19, 2011

Pre Close Charts & Market Musings (HPQ)

By Hedge Ly | 8/19/2011 02:47:00 PM |

|

| 5 min SPU |

The chop fest that has been today is nothing short of expected, same games different day. The first game which tickled the bulls asses was the 30 handle ramp off 1121 all the way up to 1153.25.. This ridiculous ramp of interesting proportions was quickly faded down to the channel of a broadening formation as you can see in the chart above. From the point the ES_F broke 1135 around noon the index's and crude have been offered all the way down to 1120 before a last ditch blip effort by the machines pushed us up to 1126.

Individual stock speaking i am seeing increased weakness among the larger cap leaders, obviously HPQ & IBM being down 20% on the day has not helped the situation. Though take a look at SINA SOHU AAPL GOOG, all down through many key levels. Specifically SINA below 90 might send the YANG bear 3x ETF back to 24 a share...

For the close look for 1120's to be defended with mine fields of stops below that level all the way down to 1110.. if 1110 fails to hold 1100 is in the carts for monday. Trade what you see and listen to the volume not the TV.

|

| crude 1 min. 83 previous support now resistance. |

Thursday, August 18, 2011

Gold Chart Update. Huffington Post Calls Top. Gold Goes higher (GLD)

By Hedge Ly | 8/18/2011 02:41:00 PM |

As you an see the bulls marched on into gold as the eurozone once again goes berserk. 1900 is on the horizon, perhaps tonight.

GC is coiled up as the dollar is weak on a day where the markets are also weak including commodities. Peculiar i know, but it it is days like these when battles are won and last. Stay away from thinking and trade what you see. Focus on price and patterns, not the television and not your stock picking service. Trade your game. If you dont have a game, step back till you see your set up..

was the SPOOZ into the close as the 1130 level is a big one.. coinciding with crude lows and NQ .. WITH HPQ sinking, the DOW is finally reflecting reality down 477.. near a full on 100 point move if the 10870 level fails to hold.

GC is coiled up as the dollar is weak on a day where the markets are also weak including commodities. Peculiar i know, but it it is days like these when battles are won and last. Stay away from thinking and trade what you see. Focus on price and patterns, not the television and not your stock picking service. Trade your game. If you dont have a game, step back till you see your set up..

was the SPOOZ into the close as the 1130 level is a big one.. coinciding with crude lows and NQ .. WITH HPQ sinking, the DOW is finally reflecting reality down 477.. near a full on 100 point move if the 10870 level fails to hold.

|

| YM 5 min |

Wednesday, August 17, 2011

A look At SPU Volume on Daily Bars (SPX)

By Hedge Ly | 8/17/2011 06:31:00 PM |

|

| daily bars SPU or on twitter known as the ES_F |

Now focus on the far right hand volume bars of the chart which correlates to the decline from 1350 to 1077. THEN look at the bars which correlate to the rise from 1100 to 1200, those bars are inside the white horizontal highlight within the volume plot. 1200 is a level you should be concerned about the bulls not protecting. TODAY is the 3rd day in a row we have failed to close above 1200 despite intra session spikes via buy programs.........

Tuesday, August 16, 2011

The Evolution of 'Social Investing' Part II (TWIT)

By Hedge Ly | 8/16/2011 10:31:00 PM |

Part 1.

During the last three years of the ‘social investing’ revolution the average investor has gained access to information previously coveted & held close by ‘professional traders’. The markets have functioned without social media prior to 2008 with periods of volatility spaced out in YEARS not day’s weeks and months. Though in late 2008 we saw a near collapse of the last bastion of greed as social media was perking up. Interesting indeed…

During the last three years of the ‘social investing’ revolution the average investor has gained access to information previously coveted & held close by ‘professional traders’. The markets have functioned without social media prior to 2008 with periods of volatility spaced out in YEARS not day’s weeks and months. Though in late 2008 we saw a near collapse of the last bastion of greed as social media was perking up. Interesting indeed…

That being said lets get back to my part I analogy of the Ferrari…. Since about April of 2008 the twitterverse has handed a Ford focus driver (the average investor/trader) the keys to a Ferrari and were told to floor it and to not worry about that paddle shift F1 gearbox (direct market access coupled with privileged information) just “learn as you go’. Some drivers (armchair investors) might really grasp the wheel and drive off into the sunset while others might get themselves into trouble they could have never EVER imagined before.

What type of trouble can you get into you might ask? Well for one most professional traders who were around before the twitter world exploded with traders exchanging information were trained to react to market moving information in a calm and constructive manner. Average investors were not using as many of the ‘exotic’ trading techniques professional investors have used for years.

Post Close 5 min Equity Index Futures Charts (SPY)

By Hedge Ly | 8/16/2011 05:58:00 PM |

|

| 5 min ES_F |

quick note....Notice the line from 1116.50 up to 1201.5. .. interesting trend eh? THE SPOOZ is about 10 handes off highs before NYC close.

Today was a back and fill day, no new ground was gained or lost.. wash.. watch the 1180 level this evening as this is where buyers stepped in this afternoon after we fell off 1201.5

1200 Rejected With Conviction As Bears Roar (SPY)

By Hedge Ly | 8/16/2011 12:19:00 PM |

|

| ES 1 min |

The S&P500 futures chart on the left is a 1 min, notice the PEAKS slightly over 1200 both yesterday @ cash close and today near MID day. WE have been seeing these mid day breaches of highs on the regular since last weeks shenanigans. Expect this and expect a downward reactionary move in price action because i believe these moves are only HF trading melt ups which the programs have all intentions of selling the hell out of the index once they buy there is all to buy. The algo's since the bid depth is getting shallow, then they flip at extremes.

The ES pivoted at 1180, after falling from the day high of 1201.5. This move took one hour. The melt up took all morning.

Dollar futures are finding bids.. as well as the USD/CHF cross.. CRUDE has been leading equity index's once again, up and down.. learn from this. and profit from it.

|

| NQ 5 min |

over and out.

Morning Equity Index & Commodity Correlations (USO)

By Hedge Ly | 8/16/2011 07:41:00 AM |

|

| CL, ES, NQ, GC |

Risk on, Risk off.

Monday, August 15, 2011

'All Quiet On The Home Front' - Late Night Market Update (QQQ)

By Hedge Ly | 8/15/2011 10:26:00 PM |

|

| CL, ES, NQ, 6E |

As you can see in the ES chart and my previous post, the NYC closing future sprint very bearish taking us from 1199 to 1194.75.

For the bears 1200 was defended after a 125 point straight up ES_F move up in 4 days. The Bulls played their games for 125 points on declining volume.. when i say declining volume i am talking the last 7 or so GREEN days the volume has declined, all while the RED days we saw near record ES contract volumes.

Levels to watch tonight. 1194 down to 1192.. below we could see 1190 and below. Watch for either the laser precise bears or the persistant bulls to take control before the open. Make or break today.

Crude seemed toppy on the 5 min around 88 with 87 being a sticky level to watch.

euro kinda weak 1.442 is the level the bulls are showing interest in.

As i type this.... ES fell over 1195 in a waterfall like fashion... same with NQ.. chart below.

|

| ES 1 min |