|

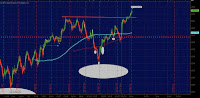

| Daily RUT inverse H&S |

Trends like we saw today do not come every day as the fluidity of today's tape is one that has alluded us for sometime. If you identified today's pattern of higher highs and higher lows you were able to catch 10 points of upside in the ES_F.

The real story was in the Russell 2000 RUT as it traded into a new all time high of 899.24 closing up 0.72% +6.4396. The chart in the upper right shows the inverse H&S breaking out over 835 which we highlighted here in plenty of time for anyone to catch the swing.

The Nasdaq 100 NDX 2.95 points or 0.11% to close @ 2746.19 as weakness in shares of GOOG and AAPL weighed on the tape.

Apple managed to move higher into the close trading 506.63 currently 509.10 AH as google reported and surged to 739. Also Research in Motion added 13%.

Apple managed to move higher into the close trading 506.63 currently 509.10 AH as google reported and surged to 739. Also Research in Motion added 13%.

|

| Weekly SPX inverse H&S |

The S&P was aided by a strong performance of the financials today which saw the XLF make a 3 year high of 17.36 to close @ 17.31 up 0.93 points. WFC also up their annual dividend by 14%.

SPY: Support = 149 Resistance = 149.50, 149.72

QQQ: Support = 67.40 Resistance = 67.60, 68