5 hours ago

Wednesday, October 31, 2012

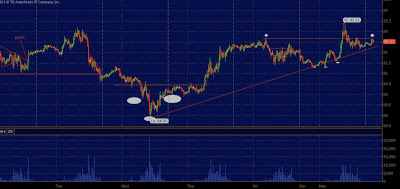

Post Hurricane #Sandy $ES_F chart - S&P 500

By Hedge Ly | 10/31/2012 06:47:00 AM |

|

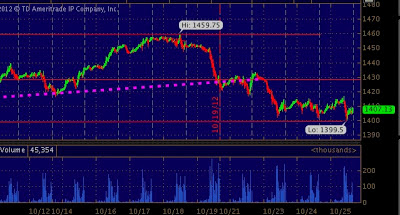

| 30 min ES_F |

1405 remains support on the 15 min.. 1410 support on the 5 min... over 1420 on the 30 min means 1424. A level which has not been seen seen 10/23. below 1405 means we dabble with 1400-1393 again...

|

| 5 min ES_F |

Post Hurricane Sandy Gold chart - $GC_F support held at 1700 -

By Hedge Ly | 10/31/2012 06:09:00 AM |

Monday, October 29, 2012

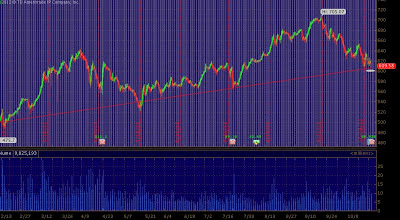

A 4 hour look at the 30 year bond future contract $ZB_F

By Hedge Ly | 10/29/2012 10:54:00 PM |

The contract is in a 4 hour pennant which has contained the price within the barriers of the formation with much conviction. What will happen now that we are @ 149' resistance? a pivot lower once actual volumes shows back up? or will a violent surge high push short stops which have built as the pattern has solidified? we shall see...

|

| 4 hour ZB_F |

Friday, October 26, 2012

Interesting thoughts from Home Depot co-founder Ken Langone $HD

By Hedge Ly | 10/26/2012 05:24:00 PM |

Billionaire financier and Home Depot co-founder Ken Langone told Bloomberg Television's Trish Regan on "Street Smart" today that he is "proudly part of the 1%. I worked like hell to become part of the 1."

Langone said that, “I have been in Wall Street all of my life. I love it. It has been good to me… This vilification of what is going on in America today is disgusting.”

Source: BLOOMBERG TELEVISION

Thursday, October 25, 2012

Wednesday, October 24, 2012

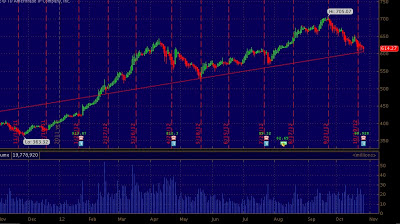

A Hourly and Daily look at the $ES_F / $SPX

By Hedge Ly | 10/24/2012 09:25:00 PM |

|

| Daily ES_F |

This break (highlighted by the white oval) has clearly been documented by trend followers per the uptick in volume the day the dotted line failed for the second time October 23rd.

Will 1400 hold? probably not if 1401.75 fails to hold, next up it 1380 as a plethora of stops i am sure reside at the 1400 level and lower, both macro buy and HFT sell. The 1400 level has quite a bit of volume associated with it as it was the magnetic level of choice from late july until the break higher over 1408 in September.

|

| Hourly ES_F ( notice the white oval) and the break of the purple dotted line. |

Wednesday, October 17, 2012

A look a the $DOW chart - Dow Chemical

By Hedge Ly | 10/17/2012 12:34:00 AM |

Take a look how DOW pushed over the 30 level this morning and traded into 30.27. Easy set up.. u got it for free.

Pressure building under the 30 level appeared to reach a head in the last hour of trading Tuesday... perhaps inverse head and shoulders could carry the price into 31 if the 29.99 is broken an converted to support.

|

| 1 min DOW |

|

| 1 min DOW |

|

| Daily DOW |

Tuesday, October 16, 2012

Tuesday, October 9, 2012

Friday, October 5, 2012

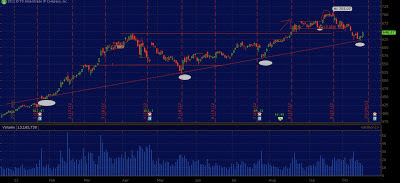

1 hour support in the $ES_F 1460 - $TLT

By Hedge Ly | 10/05/2012 01:28:00 PM |

|

| 1 hour ZB |

1468 is the high for 2012, despite the headlines about impending doom, somehow we are within spitting distance of highs. Oil though, seems to be very politically motivated lately.

|

| 1 hour ES |

Join the Trade For Prof.it forum free of charge for real time market color as well as the ability to trade shoulder to shoulder with seasoned traders.

Thursday, October 4, 2012

Former JPM CEO: Dimon's pay shouldn't be cut over London Whale (interview)

By Hedge Ly | 10/04/2012 05:28:00 PM |

Former JPMorgan CEO Bill Harrison appeared on Bloomberg Television's "Market Makers" with Erik Schatzker and Stephanie Ruhle today, where he said, "I wouldn't penalize" Jamie Dimon over the bank's $5.8 billion loss in its CIO unit. Harrison said, "That might be a controversial statement. I think Jamie is doing a great job."

Source: Bloomberg Television

Bill on JPMorgan's $5.8 billion trading loss and what the bank should do about Dimon’s pay:

"I would not penalize him. That might be a controversial statement, but I think Jamie is doing a great job. I think you have to look through this whole thing and see what happened. The stock is just about back to where it was. $5 billion was a big number, but in the context of Q2 earnings, it was very manageable. So the model worked. Mistakes we're made…I wouldn't go after the CEO in a case like this. If it was a $100 billion loss and the company is heading south, than yeah, that's a different thing."

Bill on why big banks are trading at a discount right now:

"Size and scale, leadership position, globality, that is a great advantage. Today it is not being recognized in the market because the big banks are not in favor for a whole bunch of reasons and that will change because economics will drive that. I have such a strong feeling that these big universal banks, if run properly, will create a lot more value….It is the perception of risk by investors today. There has been enough that has happened."

"Now, you've got all these suits--the suit a couple of days ago by the attorney general. This stuff just keeps coming out. There is not a lot to those but they are there and it spooks the investors and investors are looking at the losses that have been incurred. The unfortunate loss that JPMorgan incurred in London, of course. These are surprises that the market does not like but you have to look through that and say long term is this the model that will produce more value for the clients and shareholders and I think it will."

Tuesday, October 2, 2012

Pre Market Musings for October 2nd - $ES_F

By Hedge Ly | 10/02/2012 07:00:00 AM |

via

|

| 5 min ES _F |

Amid a rate cut out of Australia and rising Spanish bond price US equity indexes are higher ahead of Tuesday's trade. Currently the S&P 500 future contract is higher by 7.50 points or 0.52 percent to 1444.50 while the Nasdaq 100 future is higher by 13.00 points or 0.47 percent to 2801.25.

European indexes are higher despite continued worry by invetors and traders Spain may ask for a bailout due to this Spanis and Italian bond prices pushed higher Tuesday. As of this writing the German DAX is higher by 0.40 percent while London's FTSE 100 is higher by 0.18 percent.

Asian indexes are mixed following the Aussie 0.25 percent benchmark rate cut. The Hang Seng reacted positively to close up 0.38 percent while the Nikkei 225 ended lower by 0.12 percent.

Currency markets are tipping in the favor of risk this Tuesday morning with the Euro US Dollar cross higher by 0.28 percent to 1.2924. US Dollar futures are lower by 0.11 percent to 79.83 while the Aussie rate cut sent the AUD/ JPY pair lower by 0.56 percent to 80.55.

Commodity markets are favoring risk as well with front month copper prices leading up 0.71 percent to 3.81275. Crude oil futures are higher by 0.08 cents or 0.09 percent to 92.56. Spot gold prices are lower by 3.30 points or 0.19 percent ot 1780 a contract.

Shares of Apple bounced off 660 support in pre-market trading to indicate an open at the 663.70 level from a 659.39 close Monday.

Shares of Bank of America are higher to 9.10 in early trading, up from a 8.96 close Monday.

Despite the New York AG announcing they are sueing JP Morgan over mortgage backed securities fraud after the bell yesterday shares are only slightly lower in pre-market trading to 40.93 after closing at 40.97 Monday.