|

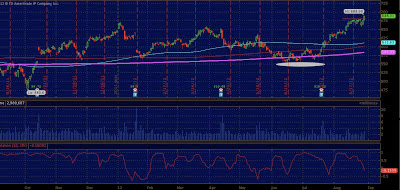

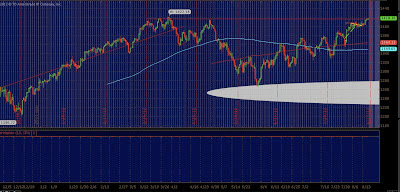

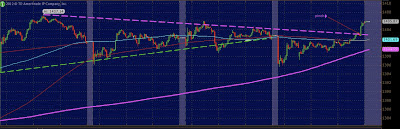

| If the 1390-80 level (white oval) fails notice the pink line support @ 1363.63 |

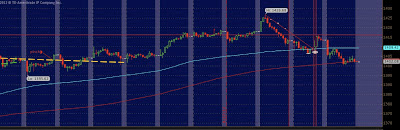

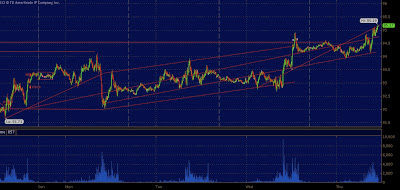

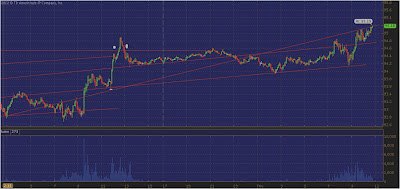

All signs pointed today to the removal of risk across a large range of assets in including commodities, much of which flowed into the bond market for safe keeping.

The failure of the 1409 level in the SPX this morning was a key area as it was outside of the standard deviation channel we have been chopping around in the past week and a half. Despite the afternoon bid off 1395.25 in the futures, market the sellers came right back onto the tape in the final 15 minutes of trade after cash markets closed. My guess is the goal is to create the illusion of maximum confusion ahead of whatever tomorrow brings.

Tomorrow may bring nothing but the same "hands off" rhetoric... Bernanke may very well save his bullets for a very rainy day, perhaps the day Greece KO's the euro? In any case, you can expect sellers to try and dominate the tape tomorrow because of the close under 1400 today.

|

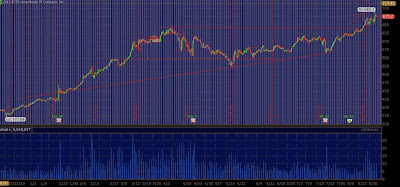

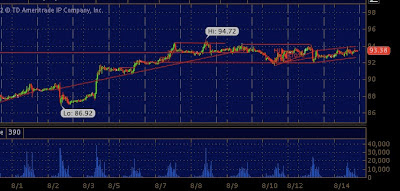

| weekly SPX (notice inverse H&S pattern) SPX 1390 (purple oval) is initial support if we give way tomorrow on the open. below that we have air gaps about ever 10 points down to 1363.63 |

|

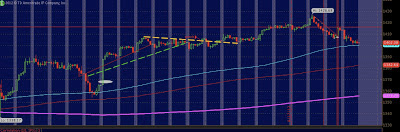

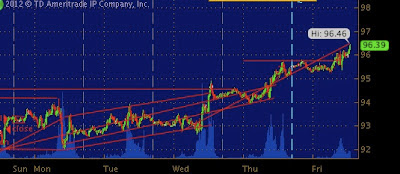

| 4 hou TLT |

If you are looking for real time color and analysis stop by the Trade For Profit forum tomorrow.