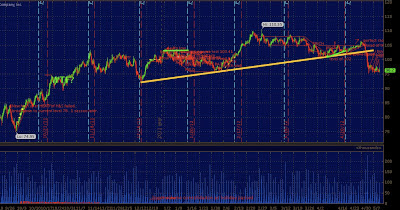

Crude continues to crush itself after failing a clear uptrend at the 105 level just under two weeks ago. Tonight crude has traded into 92.60 despite the dollar and euro remaining quiet after their Tuesday afternoon antics.

What is startling about crude's current price action is the fact the percentage losses are not slowing up as as prices continue to decline with zero notable bounces.... We all (should) know the lower the price falls in crude (or any asset) the smaller the dollar amount equates to a %. What i am saying is declines of a dollar are going to become larger and larger percentages, accelerating margin calls and the rolling up of positions in a nut shell... im thinking risk slides...

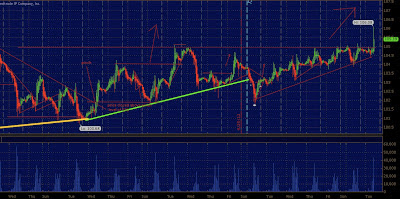

I am looking to the 92.50 level tonight, if this level were to fail 92 on the deck... if this is to fail 90 on deck.. then 87.. 85 .. then euro crisis low of 74.95. If this were to happen you can bet the DX will be at 83-85 and ES 1200-1250 area.

ON the flip side.. if 92.50-60 holds a re test of the 93 scene of crime would not be out of question.

|

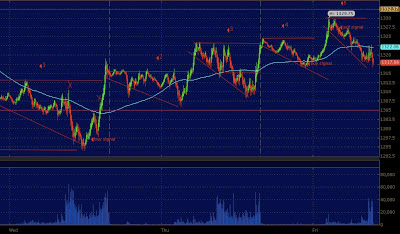

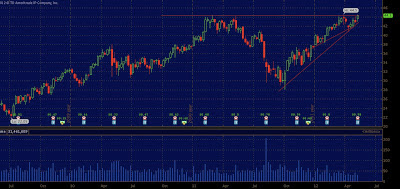

| 4 hour crude.. notice the 105 trend break of the green line |

|

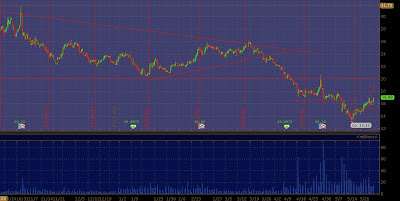

| Daily crude (notice the 74.95 level) |

|

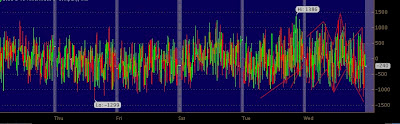

| 5 min crude |