FIRST: Whitney's cautious comments on Bank of America sent the market into a dive, regardless of what CNBC might have to say. If this were last year she would have been live on the air.

FIRST: Whitney's cautious comments on Bank of America sent the market into a dive, regardless of what CNBC might have to say. If this were last year she would have been live on the air.

It looks like someone might have have suspected this wave of secondaries now as all the major banks have paid and or are pledging to pay back TARP. Given GS's15% fall from its 52week high along with BAC and C's recent weakness someone knew the gig was about up. I believe not all banks repaying TARP are nearly ready, but they are playing follow the leader. A whole new systemic risk could be in the making. It looks like all the funds are done chasing GS just to say they had her on the books as the the printing presses are in full force, it sure does not look like much is going to be done about the dilution. Screw the shareholders but save the algo's!. Since it is the algo's keeping these POS's afloat why not dilute? Anyway this is all beside the point..

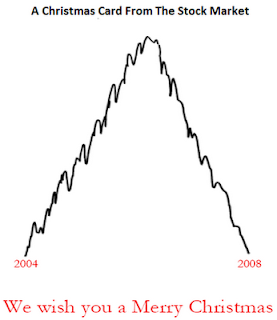

The point of this ramble is: What are the financials failing to make 52week highs telling you? It tells me the canary is slowly dieing. It should be telling you to approach trades with a clear exit plan if things are to get crazy in the near future. Call me crazy but there are quite a few strange disconnects lately complicating an already complicated tape. , , dollar up. all WHILE the ES is making 52 highs...

The root of the disconnect i do truly believe is a weakening carry trade, i do not know how long the dollar will continue its march higher but until it retreats we are going to see further volatility. This volatility i hope will make for an interesting first few months of 2010. Wow i cannot believe it is 2010... Anyway, the markets have clearly shed quite a bit of volume lately, making our daily ranges unbearably boring and flat. These environments i feel are best traded lightly as thin volume always makes for interesting price spikes.

Most of you know i use Golden Slacks as my canary, she really took it on the nose Tuesday 12/19/09, looks like even the buy the low tick program could not stop selling. The volume did not impress me, though selling under the daily VWAP did. Keep you're eyes peeled coming into this new year, the market can very well go ape shit just as you get your Christmas Pajama's on. So be ready, we saw how Thanksgiving turned out.

You know... those trades you regret the second you put them on. STUPID TRADES.. Non pre meditated trades are those which cost you dearly, or hell any trade which you made out of boredom or revenge etc. Think how much money you can save by cutting down on the number of non 3-5 star trades, transaction costs are diminished thus profits are increased. Applying this resolution is much harder than inexplanation i know... but the resolutions simplicity is unmatched by anything else you can do to help step up your game in 2010. I know i can save thousands of dollars if i cut back on manufacturing trades, i gotta quit cold turkey. so do you.

You know... those trades you regret the second you put them on. STUPID TRADES.. Non pre meditated trades are those which cost you dearly, or hell any trade which you made out of boredom or revenge etc. Think how much money you can save by cutting down on the number of non 3-5 star trades, transaction costs are diminished thus profits are increased. Applying this resolution is much harder than inexplanation i know... but the resolutions simplicity is unmatched by anything else you can do to help step up your game in 2010. I know i can save thousands of dollars if i cut back on manufacturing trades, i gotta quit cold turkey. so do you.