Dubai coming out and basically saying, "we spent it all" has caught me off guard just like most people I have spoken with(twitter has been buzzing with Dubai fallout talk". The timing could not be any more suspect, half day in US equities tomorrow. They gotta do a full days worth of what looks like active trading in a few hours, this could really cause moves to become exaggerated. The volume will probably not be huge, when this is the case index's can really move.

Dubai coming out and basically saying, "we spent it all" has caught me off guard just like most people I have spoken with(twitter has been buzzing with Dubai fallout talk". The timing could not be any more suspect, half day in US equities tomorrow. They gotta do a full days worth of what looks like active trading in a few hours, this could really cause moves to become exaggerated. The volume will probably not be huge, when this is the case index's can really move.Friday, November 27, 2009

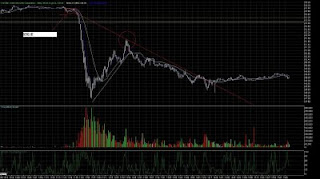

The straw that broke the camel's back (FAZ)

By Hedge Ly | 11/27/2009 01:38:00 AM |

Dubai coming out and basically saying, "we spent it all" has caught me off guard just like most people I have spoken with(twitter has been buzzing with Dubai fallout talk". The timing could not be any more suspect, half day in US equities tomorrow. They gotta do a full days worth of what looks like active trading in a few hours, this could really cause moves to become exaggerated. The volume will probably not be huge, when this is the case index's can really move.

Dubai coming out and basically saying, "we spent it all" has caught me off guard just like most people I have spoken with(twitter has been buzzing with Dubai fallout talk". The timing could not be any more suspect, half day in US equities tomorrow. They gotta do a full days worth of what looks like active trading in a few hours, this could really cause moves to become exaggerated. The volume will probably not be huge, when this is the case index's can really move.-{Full Article}-

Tuesday, November 24, 2009

A Goldman Sachs chart = a great use of screen real estate (GS)

By Hedge Ly | 11/24/2009 11:41:00 PM |

Saturday, November 21, 2009

Indicators which foretell the future? You don't say..(SPY)

By Hedge Ly | 11/21/2009 06:24:00 PM |

YES! I have found the holy grail of trading, the magic 8 ball! Well, no not exactly. Though a few indicators I use are as close as you can get to a crystal ball. No one indicator should ever be solely relied on, sampling from a core group of indicators will provide the most accurate leading foresight. Sentiment indicators are as important as ever given our current unforgiving market environment.

YES! I have found the holy grail of trading, the magic 8 ball! Well, no not exactly. Though a few indicators I use are as close as you can get to a crystal ball. No one indicator should ever be solely relied on, sampling from a core group of indicators will provide the most accurate leading foresight. Sentiment indicators are as important as ever given our current unforgiving market environment.The first indicator i want to focus on is PREMium, a leading indicator, which is the spread between the S&P's futures & S&P's actual cash value. (A great explanation on how to read $PREM here) In a nut shell this leading indicator can help tell you where the S&P's(SPDRs) are going before they get there.

*I recommend reading this Interview with Hank Camp who is an expert in program trading & interpreting $PREM.

-{Full Article}-

Wednesday, November 18, 2009

Pre market musings for 11-18-2009

By Hedge Ly | 11/18/2009 08:15:00 AM |

*I should do more pre market posts, sometimes i get so caught up in my pre market routing posting slips my mind.

*I should do more pre market posts, sometimes i get so caught up in my pre market routing posting slips my mind.

You may or may not know this week is OPEX week, the 3rd Friday of every month is the special day where out sized gains can be made and or lost. Understanding the tape heading into Friday could mean a good month or bad month. If you remember last years November expiration the market was completely out of way, not one single person knew what the market was gonna do. That day i saw more incredible trading opps because A. short selling was banned B. stocks were falling and C. everyone was caught off guard. This three factors all played a vital role shaping the tape. My thoughts on this OPEX are either the market turns around slamming through downside strikes creating huge trading opps, or as we all know the market may just have its hand held all the way through Friday.

-{Full Article}-

Tuesday, November 17, 2009

SAC Capital sells 90% stake in Bank of America

By Hedge Ly | 11/17/2009 01:49:00 PM |

The story i first saw at The Business Insider, shows SAC took their beans off the table sometime last month. Bank of America is leading the financials, the money has to follow the money. If hedgies start taking profits my feeling is they will follow each other. It takes a lot to move BAC, and when she starts looking sick, she is probably already sick. Here decline the past few weeks was probably the incubation period for her sickness.

The story i first saw at The Business Insider, shows SAC took their beans off the table sometime last month. Bank of America is leading the financials, the money has to follow the money. If hedgies start taking profits my feeling is they will follow each other. It takes a lot to move BAC, and when she starts looking sick, she is probably already sick. Here decline the past few weeks was probably the incubation period for her sickness.Now lets see if CNBC reports this story... sparks will fly if they do, much like Whitney's comments.

Monday, November 16, 2009

The melt higher. Scenario recognition. (BMY)

By Hedge Ly | 11/16/2009 02:41:00 PM |

Today was a prime example of the trading we have been seeing for weeks now. You know, gap higher on some fluff PR's from pre market then the sideways trade begins. Today was more of a "melt" higher than a straight gap up then sideways. Recognizing scenarios like today are key to profiting in market conditions where only a few names present solid opportunities. Very light volume on the upside today was the tell tell sign bears were not completely asleep, when Whitney came on and said she was the as "Bearish she has been" the bear's showed their might and slammed us on nice volume back to the 50 day MA (15 min ES_F chart), which we happened to bounce hard off of at the open.

Today was a prime example of the trading we have been seeing for weeks now. You know, gap higher on some fluff PR's from pre market then the sideways trade begins. Today was more of a "melt" higher than a straight gap up then sideways. Recognizing scenarios like today are key to profiting in market conditions where only a few names present solid opportunities. Very light volume on the upside today was the tell tell sign bears were not completely asleep, when Whitney came on and said she was the as "Bearish she has been" the bear's showed their might and slammed us on nice volume back to the 50 day MA (15 min ES_F chart), which we happened to bounce hard off of at the open.-{Full Article}-

Friday, November 13, 2009

The Genzyme trade. Focus on key words like "garbage" (GENZ)

By Hedge Ly | 11/13/2009 02:59:00 PM |

Not every day trades like GENZ come around and really perform. Trades like this you must interpret the news extremely quickly and make a directional decision even faster. I look for key words like "death" "failure" "success" Phase III etc. In Genz case i heard "garbage" and "bits of steel found in drugs" this told me alright pull up OTM puts and take the offer. Once i saw the volume come in and it start to puke i sized up bot and held onto my coconuts.

Not every day trades like GENZ come around and really perform. Trades like this you must interpret the news extremely quickly and make a directional decision even faster. I look for key words like "death" "failure" "success" Phase III etc. In Genz case i heard "garbage" and "bits of steel found in drugs" this told me alright pull up OTM puts and take the offer. Once i saw the volume come in and it start to puke i sized up bot and held onto my coconuts.Trades like these are risky but any FDA news can really move a bio tech/bio pharm stock HUGE causing volatility to go nuts and even better the market makers pull out of the options. When the market makers pull out of the options you know Sh*t is hitting the fan and even THEY do not know where this market will go.

-{Full Article}-

Fun friday reading..Vegas Nightclub files for BK

By Hedge Ly | 11/13/2009 07:59:00 AM |

When I first read this story on Zero Hedge I laughed out loud. These Vegas clubs are run poorly in sure, probably all those celebrity appearance fees they pay out cutting into EBITA. Anyway the club "Prive" which was at the planet Hollywood hotel, which in my opinion was a terrible idea from the get go considering the restaurant end of that pop stand blew.

When I first read this story on Zero Hedge I laughed out loud. These Vegas clubs are run poorly in sure, probably all those celebrity appearance fees they pay out cutting into EBITA. Anyway the club "Prive" which was at the planet Hollywood hotel, which in my opinion was a terrible idea from the get go considering the restaurant end of that pop stand blew.

This Vegas blow up is further proof this economy is sparing no one, maybe this is the tip of the iceberg? Remember when E-Trade said it had sub prime exposure? What happened after that.. all the skeletons came out of the closet across all companies and the market crashed. No more bets please. one more drink?

Thursday, November 12, 2009

The biggest moves happen when you least expect them (GS)

By Hedge Ly | 11/12/2009 02:50:00 PM |

-{Full Article}-

Wednesday, November 11, 2009

E-mini gunning the new "Cool" (SPY)

By Hedge Ly | 11/11/2009 01:12:00 PM |

The pragmatic capitalist had a great post on the mystery buyer in the futures markets as of late (via zerohedge). I too noticed the the odd occurrence which seems to show itself on very low volume quite days. You know at im talking about, the futures touch, say the 200 MA, then out of the blue the "mystery buyer" rips the futures 10 handles on zero catalyst. What is the rush? A great example is today, veterans day. We all know participation is light on a holiday, but the mystery buyer still wants his futures. The moving averages are clearly the triggers on these buy programs, we tried getting through 200 day MA on the 15 min e mini TWICE, both times we bounce almost 10 handles on 40k contracts.

The pragmatic capitalist had a great post on the mystery buyer in the futures markets as of late (via zerohedge). I too noticed the the odd occurrence which seems to show itself on very low volume quite days. You know at im talking about, the futures touch, say the 200 MA, then out of the blue the "mystery buyer" rips the futures 10 handles on zero catalyst. What is the rush? A great example is today, veterans day. We all know participation is light on a holiday, but the mystery buyer still wants his futures. The moving averages are clearly the triggers on these buy programs, we tried getting through 200 day MA on the 15 min e mini TWICE, both times we bounce almost 10 handles on 40k contracts.-{Full Article}-

Tuesday, November 10, 2009

Monday, November 9, 2009

"Victory for the Bulls!" Dow 25,000 here we come. (SPY)

By Hedge Ly | 11/09/2009 07:52:00 PM |

-{Full Article}-

Thursday, November 5, 2009

The UUP trade. Speculation meets supply & demand (UUP)

By Hedge Ly | 11/05/2009 09:49:00 PM |

Today when the shares began trading after the halt, price discovery began. The ETF's offers lifted on block buying eventually breaking violently higher on from what I believe was a reaction to possible hedging of sorts. The hedging in reaction to the massive call buying going down on the 23 strike right after the shares began trading. Big blocks were being snapped up like hand fulls of potato chips, why not they were "". Market makers countered by buying up shares of the stock causing shorts covering. Snow ball affect.

Wednesday, November 4, 2009

Remember those XHB call buys 2 weeks ago? They could be onto something..(XHB)

By Hedge Ly | 11/04/2009 09:00:00 PM |

According to Forbes the Senate voted 85-2 yesterday moving the bill to a final vote sometimes next week. What does that mean for the XHB(home builders ETF) and those calls?(my previous article) Answer: They have a higher probability of finishing in the money if the extension is granted sometime next week, as OPEX for NOV is closing in(3rd Friday of every month). Contrary to what you may think I am not bullish on the long term trend of the industry. The industry still has substaintial roadblocks ahead before they can even think of winking at recovery, thus I believe the credit extension is good for a short term spike in the shares of TOL, LEN and the likes.

According to Forbes the Senate voted 85-2 yesterday moving the bill to a final vote sometimes next week. What does that mean for the XHB(home builders ETF) and those calls?(my previous article) Answer: They have a higher probability of finishing in the money if the extension is granted sometime next week, as OPEX for NOV is closing in(3rd Friday of every month). Contrary to what you may think I am not bullish on the long term trend of the industry. The industry still has substaintial roadblocks ahead before they can even think of winking at recovery, thus I believe the credit extension is good for a short term spike in the shares of TOL, LEN and the likes.further thoughts on the call buying: The housing industry, specifically home builders are, are in a world of crap. IF the call buys were in further out months with some out of the money calls being sold i would be a bit more bullish on the recovery. Until I see actual signs of recovery i wont make any bets like these unless they are intra day scalps or 1 -5 day directional bets using options as leverage.

Tuesday, November 3, 2009

SPY chart update. You be the judge. I'll help paint the picture

By Hedge Ly | 11/03/2009 10:35:00 PM |

The blue circle at the bottom highlights increased volume in relation to the shares falling through the macro trend line(failure around 106). Looks like the next stop could be 101.68 level where we come to support at the 161 fib level from the 25% retrace point @ 88 PPS.

Interpret this chart as you will, just keep in mind this market has proven to be driven by technicals coinciding with changing market sentiment(like we have the recent week or so). Another not for the bulls, I agree we are a bit oversold on the daily, though we all know how these lower indicators can get all wound up and meaningless at extremes.

H1N1 - unemployment - retailers how are they correlated? (AMZN)

By Hedge Ly | 11/03/2009 02:37:00 PM |

I believe some of the best macro/correlation trades are ones which seems so obvious yet hard to pull the trigger on. I was talking with a buddy of mine today, whom i will credit with allowing me to think outside the box on this topic. Ready for the trade?

I believe some of the best macro/correlation trades are ones which seems so obvious yet hard to pull the trigger on. I was talking with a buddy of mine today, whom i will credit with allowing me to think outside the box on this topic. Ready for the trade?

Ok. So we all know the "swine" as it is known on the street is causing a ruckus among US citizens. The swine bombs timing is not good for retailers whom are being hit with consumer spending retraction. If combined with the apprehension of people not wanting to be around large groups for fear of contracting the "swine" retailers will take a double hit.

-{Full Article}-

Monday, November 2, 2009

NYSE penny pilot program rolled out 75 new names today (NYSE)

By Hedge Ly | 11/02/2009 03:04:00 PM |

For those who actively trade options on an intra day bases or swing you will be happy to know the cost of buying an option has in theory been reduced today(in 75 stocks). The NYSE arca penny pilot program has been running for a little over year now with a slower than expect roll out. The tightening of option spreads from a nickel to a penny is the primary purpose of the program. So how does this program make trading options cheaper? Well, in theory a nickel wide option you have to pay the spread no matter what, usually .05-.15 on average. Now the spread "in theory" will be a penny wide, though most still price in a spread of .07 or so. Thus when entering a position you can essentially put in an price you like all the way up to a penny away from the ask, or vise versa. What makes this program interesting in my opinion is not the reduced cost of entry, it's the fact options now price and trade in a more fluid and predictable manner than in nickels. There are now greater opportunities to exploit inefficiencies in pricing because you can see where everyone sits in the book and at what price. This makes for great scalping.

For those who actively trade options on an intra day bases or swing you will be happy to know the cost of buying an option has in theory been reduced today(in 75 stocks). The NYSE arca penny pilot program has been running for a little over year now with a slower than expect roll out. The tightening of option spreads from a nickel to a penny is the primary purpose of the program. So how does this program make trading options cheaper? Well, in theory a nickel wide option you have to pay the spread no matter what, usually .05-.15 on average. Now the spread "in theory" will be a penny wide, though most still price in a spread of .07 or so. Thus when entering a position you can essentially put in an price you like all the way up to a penny away from the ask, or vise versa. What makes this program interesting in my opinion is not the reduced cost of entry, it's the fact options now price and trade in a more fluid and predictable manner than in nickels. There are now greater opportunities to exploit inefficiencies in pricing because you can see where everyone sits in the book and at what price. This makes for great scalping.-{Full Article}-