|

| The Man Behind the Curtain (pomo) |

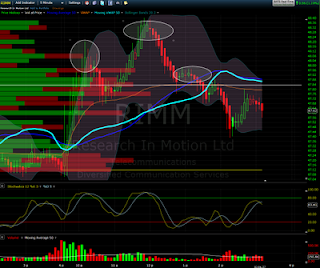

Which tanked the markets at 11:45am?

Nobody will every know what really makes the market tick in this environment, but one can surmise the drop this morning was obviously related to the

Philly fed stating more economic weakness. BUT! I believe stopping the days

POMO buying in the treasury's was the real reason why the market dropped.

Zerohedge has been highlighting

Permanent Open Market Operations affect on equities for quite sometime. He has pretty much concluded the entire rally from March until mid 2010 was a result of reinvesting interest payments into the purchase of treasuries.

To CNBC's credit they actually did mention POMO stopping for the day as a possible cause for the drop. Good work guys it only took months of the blogosphere covering the thesis for you to report on it. Blogging is the new medium for financial media and information exchange. I enjoy seeing CNBC embracing the medium though they could do a bit more of crediting bloggers for idea generation. I have seen many times CNBC use something a bloggers thesis (COUGH, zerohedge) on air as their own thesis.

.jpg)